Maintaining Price Stability for Kenya's Prosperity

The Central Bank of Kenya formulates monetary policy to achieve and maintain price stability, fostering a sound and inclusive financial system.

129.00

9.00%

4.46%

7.73%

Featured

FeaturedKenya National Financial Inclusion Strategy (2025-2028) Launched

The National Treasury Cabinet Secretary launched the new strategy alongside the Fourth Medium Term Plan and Women Entrepreneurs Finance Code, marking a significant milestone in Kenya's financial inclusion journey.

Survey

SurveyAgriculture Sector Survey of November 2025

Survey

SurveyMarket Perceptions Survey of November 2025

MPC

MPCMonetary Policy Committee Decision - December 2025

Upcoming Events

T-Bill Auction

MPC Meeting

Infrastructure Bond

T-Bill Auction

Market Data

Real-time exchange rates and treasury securities

Exchange Rates (Indicative)

USD/KES - 7 Day Trend

| Currency | Rate (KES) | Change |

|---|---|---|

USD USD/KES US Dollar | 129.00 | +0.15% |

GBP GBP/KES Sterling Pound | 173.26 | +0.22% |

Treasury Bills

Next Auction: Jan 107.73%

8.45%

9.12%

Key Policy Rates

CBR

9.00%

Interbank

7.82%

Lending Rate

14.88%

Deposit Rate

7.28%

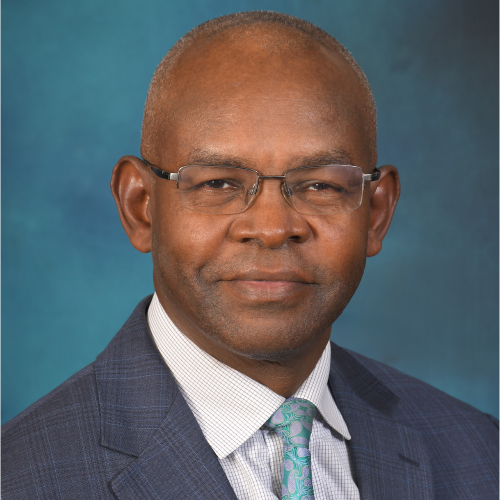

Central Bank Governor

of the Year 2024

Dr. Kamau Thugge

Governor, Central Bank of Kenya

“Our commitment remains steadfast in maintaining price stability and fostering a robust financial system that serves all Kenyans. The introduction of KESONIA marks a significant step towards greater transparency in our lending markets.”

10th

Governor of CBK

A Grade

Global Finance 2025

What We Do

The Central Bank of Kenya is entrusted with key responsibilities to ensure economic stability and a sound financial system.

Monetary Policy

Formulating and implementing monetary policy directed towards achieving and maintaining price stability.

Bank Supervision

Licensing, supervising, and regulating commercial banks, microfinance banks, and mortgage finance companies.

Currency & Notes

Issuing and managing the national currency, ensuring adequate supply of clean banknotes and coins.

Payment Systems

Oversight of payment, clearing, and settlement systems to ensure efficiency and stability.

Publications & Research

Access our latest reports, studies, and policy documents